MERGERS AND ACQUISITIONS ADVISORS

© R.L. Davidson LLC

Dave Redman direct 720-348-8562

TIMING IS CRITICAL TO A SUCCESSFUL TRANSACTION

When considering whether it is time to sell there are five key elements to examine:

1.

Are there buyers?

2.

Is your business trending up or down?

3.

Is your business ready for others to view?

4.

Is your business financially stable?

5.

Is the business at the right point in its business cycle?

ARE THERE BUYERS? May seem like an obvious question but this is often overlooked by sellers as they are thinking about

selling. At RLD we have seen times when the market place is overloaded with buyers and times when it seems all buyers have

gone underground. This herd instinct is understandable in a way but also confusing at times. Buyers are buying the future and

often the "collective" wisdom is that the future is to unsettled to make an informed decision. That is when buyers will decrease

their acquisition activity and wait for clearer signals from the market place. At other times the buyers will all agree that the future

looks bright and will crowd the market place looking for quality deals.

The critical aspect for the seller is to recognize when buyers are active. When buyers are active and abundant they will drive up

values; when they are being extra cautious they drive down values. Deals are done in the down periods but at less value than

the higher demand periods. Recognizing this timing and matching it with your decision to sell adds greatly to the value of your

company.

How do you know when buyers are active? At RLD we know based on the inquiries we receive from buyers and the multiples

they are willing to pay. We are talking to buyers everyday so we get a "feel" for the current market place by listening to the tone

of these conversations. As a seller you can contact companies such as ours or others and ask about the market. Most people

are willing to discuss the market conditions that exist. Also you can look at the projected trends in your market-what are industry

experts expecting to happen in the future. Buyers are driven by future expectations much more so than historical numbers.

Another way of knowing the activity level of the market place is to track the Private Equity Groups (PEG) that are active at any

given time. This is private money pooled for the purpose of doing acquisitions, usually in one industry. The number of these

groups and the size of the money pools available is a strong indicator of what the market is anticipating.

IS YOUR BUSINESS TRENDING UP OR DOWN? Short-term trends such as month to month are not deal killers or key

elements to buyers; however short-term trends that run longer than one month will cause buyers to pause. This is all driven by

the intense focus on the future-buyers are buying the future; not the past! Trends can be an indication of that future

performance.

Buyers are looking for performance predictability. Very volatile numbers can confuse buyers both up and down and cause

concern. A buyer is trying to forecast the future of the acquisition target and as such is looking for anything to give them an

indication of what that future will be. However; buyers in the Power Infrastructure industry understand that there are ups and

downs by the nature of the business. Normal business fluxion is expected; unusual or extreme changes can be a problem.

Obviously the best situation is for there to be a strong positive trend in place as the business goes on the market. But the seller

should not be overly focused on month to month ups and downs. The more important aspect is strong future indicators; such as

customer stability, back-log, pending contracts/bids, year to year EBITDA stability/growth and employee/management stability.

IS YOUR BUSINESS READY FOR OTHERS TO VIEW? Most business owners are proud of their businesses and do not give

much thought to how someone else might look at the business. A business owner should take some time and try and view the

business the way a seller would. Do you have good back-up management in place if you (the owner) were not there? Do you

have good financial (accounting) staff in place to function under a new owner? Is your equipment in good shape? (The

equipment is not expected to be new; but should be a mixture of age and utility with little underutilized equipment.)

As a seller you should give thought to due diligence-what does it mean and are you ready to provide answers and documents to

respond to the normal requests in due diligence?

IS YOUR BUSINESS FINANCIALLY STABLE? This question is much like the trend question but in a different perspective. If

your business is on the verge of bankruptcy your chances of selling are slim. Even if your business is not on the verge of

bankruptcy but is operating at a loss you may not be able to survive long enough to sell. Most sellers of businesses in trouble

will not make the price/terms concessions they need to make in order to sell their businesses. Always remember you are selling

the future, so if your business is losing now you are asking a buyer to take a substantial risk that it will continue to lose at the

current, or worse, rate in the future. To take that risk requires incentives in the form of a low price and maybe good terms. In

most cases a financially unstable business will not be able to find a buyer and negotiate a deal before it is too late. This is

especially true with small businesses that usually do not have access to resources to keep the doors open while looking for a

buyer.

So once again an obvious statement; the best time to sell your business is when you have financial stability. This is somewhat

different then just profitability or good EBITDA numbers. It means you have adequate working capital for the growth and

financial performance of the business. It means you have adequate resources (equipment, human resources etc.) to support

the immediate trends lines of the business. There are no surprises for the buyer related to your financial stability-buyers abhor

surprises.

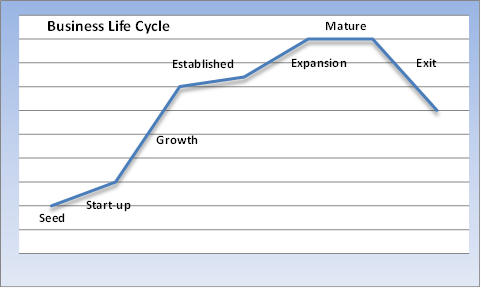

IS THE BUSINESS AT THE RIGHT POINT IN ITS BUSINESS CYCLE TO SELL? Every business has a certain life cycle.

Below is a typical chart of the life cycle of a business that is often seen in management textbooks. This chart reflects a major

mistake made by people not in the business of selling or acquiring businesses. They show the end of the business cycle as one

involving an exit of the business. If that is an exit to a new management team (family succession) or a liquidation of the

business assets this may be true. If the exit strategy involves selling the business; it is a mistake.

Chart 1.

As we have said a buyer is buying the future. Based on chart 1 above there is an assumption someone would buy the business

at the end of its life cycle-obviously this is not true or if it is true the buyer will not pay the highest price for the business. Many

business owners will tend to follow this cycle more or less unknowingly. They will time the sale of their business based on their

personal circumstances; such as retirement or health concerns. That will not maximize the value of the business. The perfect

time to sell a business is when the future of that business looks it brightest. Common sense will tell us if the buyer is buying the

future than the business owner should sell when the future looks the best.

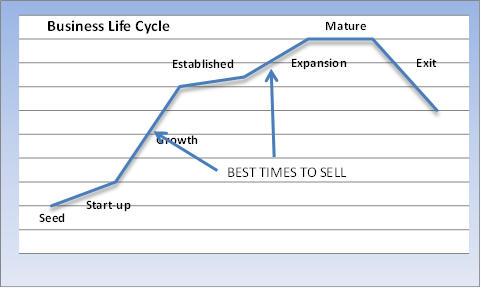

Chart 2.

Chart 2 give us a graphical representation of when it is the best time to sell. In a nutshell the best time to sell is when growth is

on the horizon. This maximizes the value and will attract the most buyers. Now obviously our chart lays this out as a simple

task of picking a point on the graph line-a real world business is much less clear.

The unknown is the future. If your business is experiencing success and growth there is a tendency to want to wait so you can

benefit the most from that current trend-but if you wait until you know where you are on the chart it can be after you have

reached the maximum value and gone beyond. We have told many buyers the best time to sell is when you would just as soon

keep the business because it is doing so well.

CONCLUSION. After you have examined these five areas you should have a much better idea on whether this is a good time to

sell or not. In many cases a close examination of your business and yourself will reveal that it is not a good time to sell. The

best thing to do at that point is to establish an objective of selling your business in the future and began the work to put your

business in a better position by that time.

We only get paid if a deal happens. There is no motivation for us to try and fool you into hiring us-and there is no motivation on

our part to take on a client we cannot sale. There are many factors that lead to a successful transaction and we work with our

clients to help them identify if it is the right time for them to sell-don't wait too long and miss out based on bad timing.

When is the best time to sell?

Update

Current market conditions have

changed many aspects of timing. The

coronavirus pandemic has impacted

what was “normal” and some of what

was true before is not necessarily the

same.

Buyers will understand the unsettled

nature of the last few months and will

overlook short-term disruptions.

Buyers will be focused on prior history

and long-term prospects.

The elements mentioned in the article

are still valid regarding the cycle the

business was in before the current

crisis.

The buyers we are talking to are mostly

interested in opportunities to grow their

existing organizations in both the short-

term and long-term with an emphasis

on quality well run companies with good

prospects for the future.

Timing a transaction still needs to be

analyzed but with an understanding of

the overall market and how the return to

“normal” will impact a specific business

transaction.

We are advising clients to explore

options now if they are ready. Based

on our conversations we believe the

buyer market is ready to begin

discussions on transactions

MERGERS AND ACQUISITIONS ADVISORS

© R.L. Davidson LLC

Dave Redman direct 720-348-8562

When is the best time to sell?

Update

Current market conditions have

changed many aspects of timing. The

coronavirus pandemic has impacted

what was “normal” and some of what

was true before is not necessarily the

same.

Buyers will understand the unsettled

nature of the last few months and will

overlook short-term disruptions.

Buyers will be focused on prior history

and long-term prospects.

The elements mentioned in the article

are still valid regarding the cycle the

business was in before the current

crisis.

The buyers we are talking to are mostly

interested in opportunities to grow their

existing organizations in both the short-

term and long-term with an emphasis

on quality well run companies with good

prospects for the future.

Timing a transaction still needs to be

analyzed but with an understanding of

the overall market and how the return to

“normal” will impact a specific business

transaction.

We are advising clients to explore

options now if they are ready. Based

on our conversations we believe the

buyer market is ready to begin

discussions on transactions

720-348-8562